Stocks in the news: SBI, Lakshmi Vilas Bank, Praj Ind, Avenue Supermarts, Info Edge

Jet Airways | Lakshmi Vilas Bank | Ashok Leyland | Avenue Supermarts | Info Edge and Vodafone Idea are stocks which are in the news today.

Moneycontrol News@moneycontrolcom

Here are stocks that are in the news today:

SBI: Bank cut MCLR across tenors by five basis points. Home loan rates for up to Rs 30 lakh have been cut by 10 bps.

Praj Industries signed a construction license agreement with Gevo Inc, USA to commercialize technology for production of lsobutanol using sugary-based feedstock

Tata Sponge Iron completed the acquisition of steel business including captive power plants of Usha Martin, pursuant to cash consideration of Rs 4,094 crore to Usha Martin

Board meeting on April 18 to cosider and approve the audited financial results and dividend for the financial year ended March 31, 2019

RELATED NEWS

Info Edge: Company has invested through its wholly-owned subsidiary Rs 6 crore in Bizcrum Infotech Private Ltd.

Avenue Supermarts: Company raised Rs 50 crore via commercial papers.

Ashok Leyland: Promoter pledged 1.33 percent stake in the company.

Vodafone Idea: Rs 25,000 crore rights issue to open on April 10 & close on April 24.

Panacea Biotec has done one-time settlement with consortium lenders to resolve the current debt position of the company

Olectra Greentech board approved the allotment 27 lakh shares at an issue price of Rs. 80.10 to promoter group Goldstone Power, against a conversion of balance 27 lakh warrant out of 54 lakh warrants which were allotted to the promoter group in October 2017

Mindtree to consider to consider the audited financial results and declaration of interim and/or special dividend on April 17

Forbes & Co: CARE revised the company's long term rating to A+ From AA-.

Jet Airways: DGCA said company's lessors apply for de-registration of 7 more planes.

Karda Constructions: Company has completed RCC work of residential building A of project Hari Nakshatra Phase I amounting to Rs 9 crore against the construction work order of Rs 18.92 crore awarded by Shree Sainath Land & Development (India) Private Limited.

Kiri Industries: Singapore Court reserved its judgement in Dystar’s minority oppression suit

Mahindra CIE Automotive completed 100 percent acquisition of Aurangabad Electricals

Analyst or Board Meet/Briefings

Mahindra Logistics: Company's officials will meet Aegon Life Insurance on April 10 and Quest Investment Advisors on April 16.

Lakshmi Vilas Bank: Board to consider raising funds via shares on April 12.

Shriram City Union Finance: Company will announce March quarter results and recommend dividend on April 24

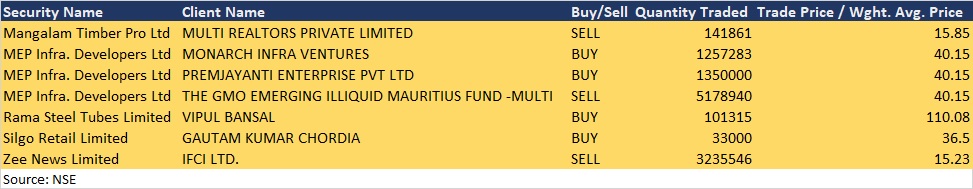

Bulk Deals on April 9

Firs

Call us :

Call us :